The role liabilities play in determining basis There is one temporary exception to the rule that a partners basis is equal to his or her cost basis in the partnership and that is the allocation for basis purposes of. Applicants must be 18 years of age in the state in which they reside 19 in Nebraska and Alabama 21 in Puerto Rico.

Investment Club Partnership Agreement Legal Forms Template Printable Investment Club

Net small business income.

. A self-employed borrowers share of Partnership or S Corporation earnings may be considered provided that. Unrecaptured Section 1250 Gain Worksheet. One-way information sharing non-disclosure agreement.

See Reporting Your Home Sale for instructions on how to report the gain on your tax return. The sale of a partnership interest is treated as the sale of a single capital asset. A marketing function is a specialised activity performed in marketing.

751 - 1 a3 also requires a disclosure statement to be included with the partnerships and with each partners tax return in. Employee confidential information and invention assignment agreement. The borrower can document ownership share for example the Schedule K-1.

Kimmel to learn about credit debt and interest ratesThey write a story about credit and debt and complete worksheets on calculating simple interest on loans. Partnership or S Corporation. 3671203 Form 568 2020 Side 1 Limited Liability Company Return of Income I 1 During this taxable year did another person or legal entity acquire control or majority ownership more than a 50 interest of this LLC or any legal entity in which the LLC holds a controlling or.

5 per square foot of home business space up to 300 square feet for a maximum 1500 deduction. The sale or transfer of a partnership interest where the sale or transfer. Is subject to the provisions of Internal Revenue Code IRC section 1060 and occurred on or after April 10 2017.

Form 1040 - Individual Income Tax Return Yr. Capital gains eg from the sale of a mutual fund or real estate are considered an increase in. Schwartz to learn about spending saving interest borrowing and lending.

Board resolution acquiror asset transfer Museums. If you request cash back when making a purchase in a store you may be charged a fee by the merchant processing the transaction. Distribution of foreign income.

Disposition of partnership interest. See Internal Revenue Code Section 731 for. In general taxpayers who have short-term capital gains short-term capital losses long-term capital gains or long-term capital losses must report this information on IRS form Schedule D.

Although it is late in the year if you were disappointed in the size of your refund or you had an unexpected balance due when you filed your 2018 tax return it is not too late to make changes for 2019. Tax-Exempt Interest Income. Always ask the merchant if a surcharge applies when requesting cash back at the point of sale.

01 During the entitys tax year did the entity own any interest in another partnership or in any foreign entity that was disregarded as an entity separate from its owner under federal regulations Sections 3017701-2 and 3017701-3. Wages salaries considered elsewhere - - 3. Bill of sale and assumption agreement.

A standard PTP sale reporting worksheet to facilitate the calculation of gains and losses that may make these calculations more efficient is available here. The part of any gain or loss from unrealized receivables or inventory items will be treated as ordinary income. Students share the book Four Dollars and Fifty Cents by Eric A.

Sale or disposition of. Under Section 704 a partner in a partnership may only utilize a loss allocated to that partner to the extent of the partners basis in the partnership interest. Technical Termination of a Partnership For taxable years beginning on or after January 1 2019 California conforms to the TCJA repeal of the termination of a partnership by the sale or exchange of 50 percent or more of the total interest in a partnership within a 12 month period.

Your gain that is eligible for exclusion from Section C is greater than your exclusion limit from Worksheet 1 Section C. And The K-1 reflects a documented stable history of receiving cash distributions of income consistent with the level of business income used. Distribution of income from other partnerships and share of net income from trusts.

Here is more information about the W-4 Worksheet including how to fill out the W-4 allowance worksheet line by line. Form 6 Ordering Other Years Income Tax Forms Select Year2020 Income Tax Forms2019 Income Tax Forms2018 Income Tax Forms2017 Income Tax Forms2016 Income Tax Forms2015 Income Tax Forms2014 Income Tax Forms2013 Income Tax Forms2012 Income Tax Forms2011 Income Tax Forms2010 Income Tax Forms Numeric Listing of All Current Nebraska Tax Forms Search Forms2 -. A self-employed borrowers share of Partnership or S Corporation earnings can only be considered if the lender obtains documentation such as Schedule K-1 verifying that the income was actually distributed to the borrower or the business has adequate liquidity to support the withdrawal of earnings.

If the sum of short-term capital gains or losses plus long-term capital gains or losses is a gain the Unrecaptured Section 1250 Gain Worksheet will be produced if the return contains any of the following. The Reporting Your Home Sale section doesnt apply to you. Everything you need to know about functions of marketing.

Determines the gain or loss on the sale or exchange of a partnership interest Sec. However some state statutes give limited partners authority to vote on issues that affect the structure of the partnership such as the admission of new partners or a sale of the companys. Option A involves completing Form 8829 by calculating the total area of your home and getting a percentage for your home businessInclude the total allowable expenses resulting from those calculations on line 30 of Schedule C.

731a1 Any gain recognized is considered gain from the sale or exchange of the partnership interest. Any distribution remaining after applying the two steps above is treated as gain from the sale or exchange of property. The amount of the gain to be included in New York source income is determined in a manner consistent with the applicable.

Students share the book If You Made a Million by David M. For partners distributions in excess of basis also results in gain. A marketing function is necessary to take goods from the place of origin to the place of consumption.

Thus it is an act or operation or service in order to link the original producer and. Partnership policy you must support the costs of your long-term care through some. Some of your gain isnt excludible and you may owe tax on it.

The term unrealized receivables includes income arising from compensation for services and depreciation recapture income discussed earlier. Worksheet set forth below will show how income affects your eligibility for Medicaid. Option B is a simplified calculation.

Interest in a business family members commissions Who receive variable income have earnings reported on IRS Form 1099 or income that cannot otherwise be verified by an independent and knowable source.

Worksheet Image For Building Partnership Tool Business Plan Template How To Plan Business Leadership

Custom Handwriting Worksheets Pictures All About Worksheet Brochure Lettre De Motivation Modeles De Lettres

Partnership Agreement Template Create A Partnership Agreement Throughout Partner Business General Partnership Business Plan Template Business Budget Template

Free Property Offer Worksheet Form Printable Real Estate Forms Real Estate Forms Legal Forms Word Template

Free Property Offer Worksheet Form Printable Real Estate Forms Real Estate Forms Legal Forms Word Template

The Lemonade War Novel Study Unit Novel Study Units Novel Studies Novel Study Activities

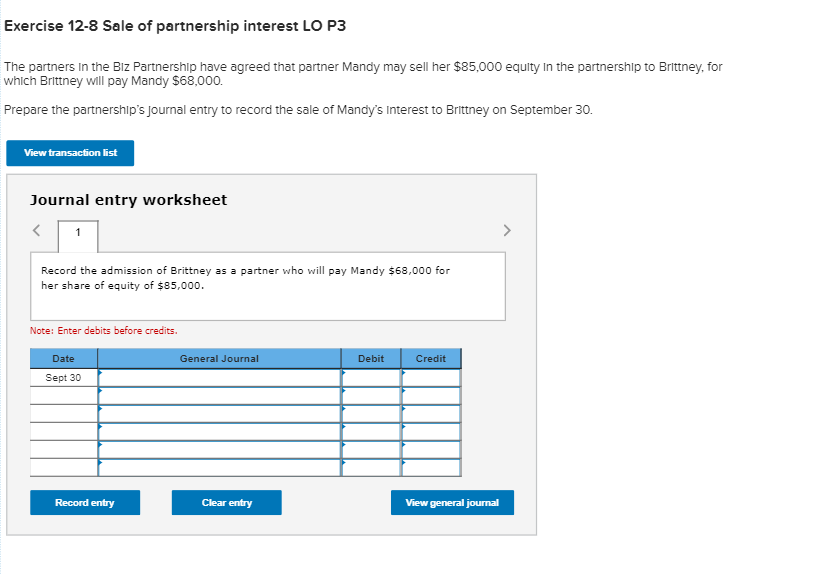

Solved Exercise 12 8 Sale Of Partnership Interest Lo P3 The Chegg Com

Partnership Agreement Templates 16 Free Word Pdf Samples Job Resume Template General Partnership Statement Template

Qualified Lead Definition Tool A Worksheet To Help Sales Marketing Departments Align On Their Definition O Public Relations Sales And Marketing Definitions

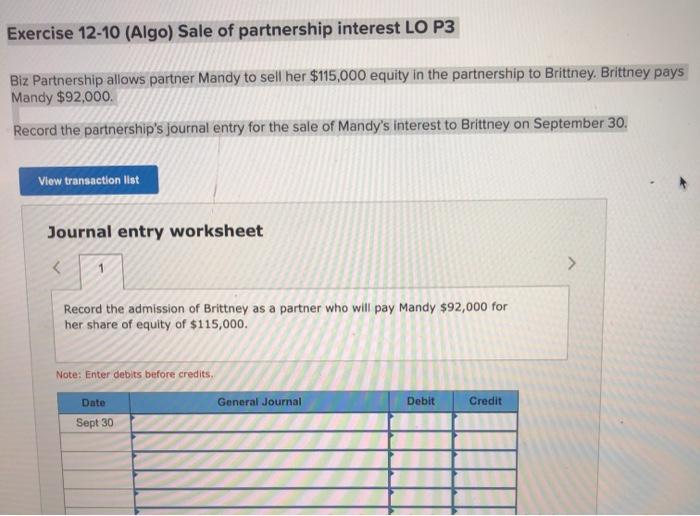

Solved Exercise 12 10 Algo Sale Of Partnership Interest Lo Chegg Com

425 1 A14 21440 4425 Htm Prospectuses And Communications Re Business Combination Transactions Filed By El Paso Pipeline Partners L P Pursuant To Rule 425 Under The Securities Act And Deemed Filed Pursuant To Rule 14a 12

Avery Com Templates 8371 Business Cards Free Online Business Card Design Temp Business Card Template Design Marketing Business Card Business Card Template Word

Fresh Non Profit Balance Sheet Template Business Plan Template Free Statement Template Personal Financial Statement

Business Partnership Separation Agreement Template Separation Agreement Template Separation Agreement Partnership

Partnership Agreement Contract Template Partnership Legal Forms

Free Prop Insp Formulas And Measurements Exterior Form Real Estate Forms Printables Word Template

Ideas Picture Free Free Business Plan Template Word Home Daycare Business Plan Templat Business Plan Template Word Business Plan Outline One Page Business Plan

Challenger Sale The Reframe Exercise Challenger Sale Challenger Exercise

ConversionConversion EmoticonEmoticon